SoSimply

Bringing B2B to B2C

September 30, 2019 · Alex Ulbrich

Table of Contents

Different frameworks:

- opportunity solution tree (then frame it as such and analyse)

- business/lean/startup model canvas (first describe this one)

What was the desired outcome for AG and Homeras? What were the opportunities?

Things we could have done:

- the network becomes the client

- use the network with new b2b customers

- use the network for b2c customers

Preference of leadership

Paying for input: consultancy

How the decision was made?

Background and Context

Desired outcome for AGI and Homeras

Inception

Homeras (the company behind SoSimply) is owned by AG Insurance, the largest insurer in Belgium. The company that later became Homeras operated in the Benelux to help insurance clients in case of claim. They leveraged a large network of contractors to operate repairs for home owners. AG acquired them around 2015 to benefit from this network directly —Homeras was born.

The goal of AG was to reduce costs related to home insurance claims by negotiating better rates and prices with contractors, while keeping the process lean and simple. AG decided to outsource part of the actual claim handling to Homeras.

This would be the typical flow:

- Insurance customer would call AG to declare a claim, or reach Homeras directly if it’s an emergency.

- AG will open a claim file and send the mission order to Homeras.

- Homeras would contact the customer to professionally evaluate the damage types and assign a contractor.

- Contractor goes on site to evaluate the damage and make a quote.

- Homeras reviews quote, eventually sending an expert on site.

- Once the quote is approved, the contractor is mandated to perform the works.

- Homeras performs follow-ups with customers and quality controls on the works.

In case of emergency, Homeras sends someone immediately for a temporary fix.

AG will then pay the invoice of the contractor directly, and Homeras gets an handling fee for that case.

Pretty straightforward.

That Works. Now What?

This model proved successful. More optimisation were planned internally to make the whole process more efficient but the concept was proven.

AG wanted Homeras to grow beyond just serving them, the insurer and parent company. This stemmed from a need to grow profits on the one hand, and on the other hand as a way to diversify to non-insurance services.

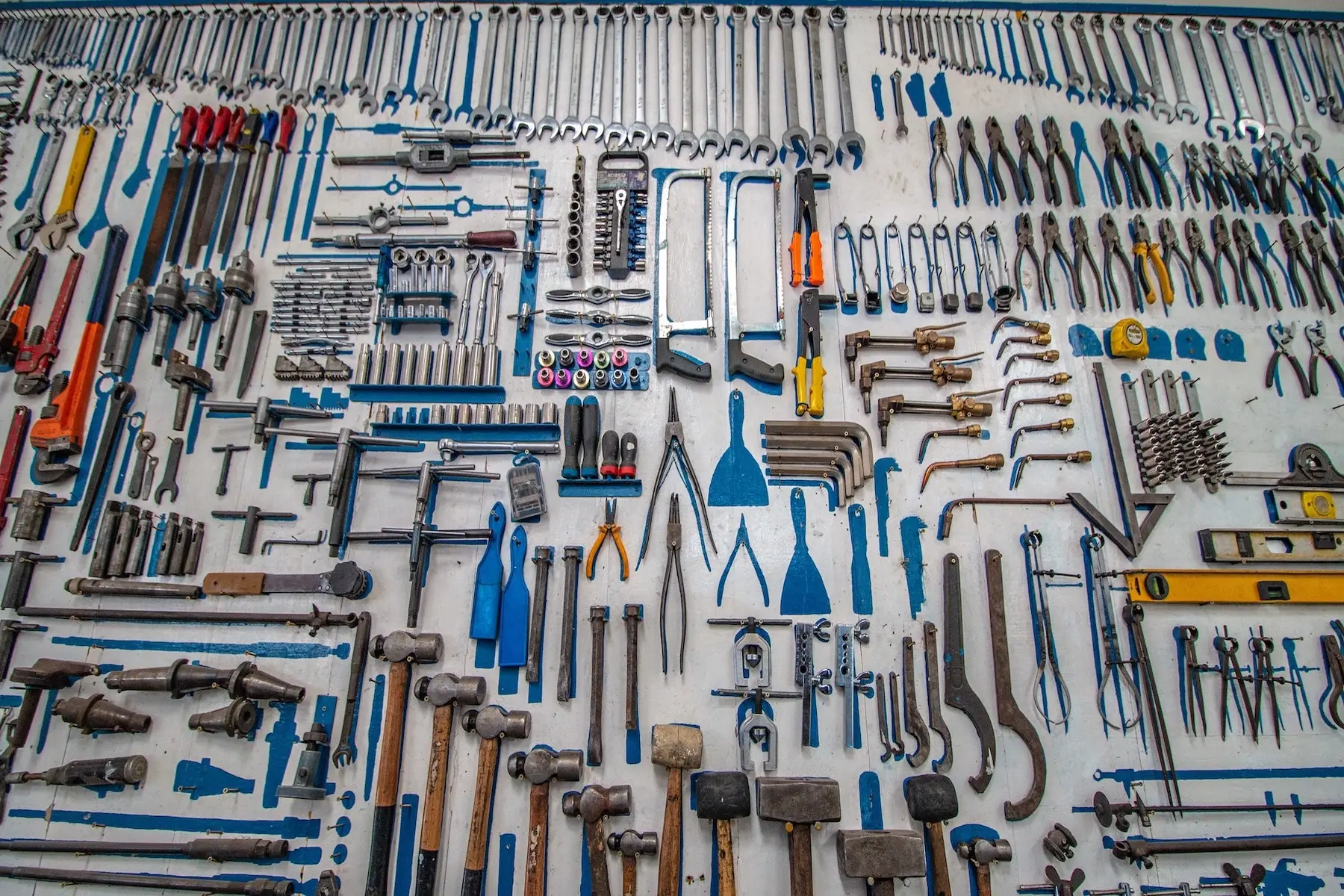

Let’s check what we have. Homeras relies on three pillars:

- the network of contractors,

- the call center —handling calls all day long and trained to assess damages to houses,

- the internal experts —able to properly evaluate quotes and assess damages.

Is there anyway Homeras could leverage these components to grow their business?

Getting Started

We had the context. Now we needed to explore opportunities.

Things We Knew, and Things We Didn’t

Analyzing the Market

Interviews and Focus Groups

First Prototype

Getting a Decision

Seed and MVP and Ghost Launch

Finding an Agency

Design Sprint

Marketing Strategy

Coming soon!